Good Scaling, Bad Scaling

Some start ups become scale ups.

There's good scaling and bad scaling.

What is scaling?

In today's language it means investing for growth.

By investing for growth the company gets to "scale", i.e. becomes larger. This scale up phase typically is funded with growth capital, often starting with "Series A" Venture Capital.

Good scaling

Quite simply put, scale up should only happen once there is a viable and repeatable business model.

The business may not yet be profitable but they have figured out how to repeatedly acquire customers at a price that makes sense. They'll know who their core customers are, where to reach them, they'll have a product that solves their needs.

Not only that, it won't just be a product that solves their needs, it will be a great product. To define great I like to refer to Sean Ellis and his "must have" product question.

He asks customers, "How would you feel if you could no longer use [product]?"

The answer choices are

Very disappointed

Somewhat disappointed

Not disappointed (it isn’t really that useful)

N/A – I no longer use [product]

If more than 40% the respondents answer, "very disappointed", you then have a "must have" product.

A must have product means two things;

- customers will be loyal, so retention will be high

- customers will be easier (and cheaper) to acquire

However, even with a great product, the start up needs to also have a clear path to profitability.

Business model fit, a must have product and a clear path to profitability are good checks for whether a start up is ready to scale.

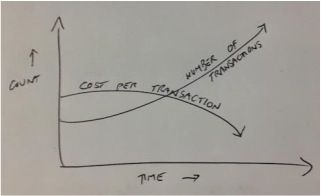

I also like to think of the scaling in terms of "economies of scale".

Here's a simple example. You have £100,000 in revenue. You have 5 people. You have 2 web servers.

What happens when you double the revenue? Do you double the team and double the number of servers? If you do, you are not scaling. You are just growing.

Scaling would mean that you doubled the revenue, but the team size and web servers did not need to double. Maybe the team went to 6 people and the web servers stayed the same. Now you're starting to scale.

Here's what good scaling looks like

Bad scaling

A startup raises seed money and gets going. Unless they become very profitable very quickly it's likely that more funding will be needed.

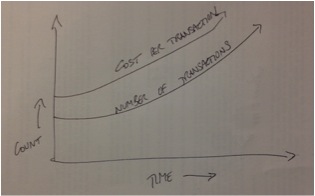

This can be a problem if the cash runs out before the conditions for scaling have not yet been met.

Some startups raise larger onward funding rounds despite the fact that they are not actually ready to scale. They pitch to investors, the investors buy the story, they raise the money.

The money is in the bank and then there's pressure to deliver on the (flawed) business plan presented to the investors. More money is spent on marketing, more sales people are hired yet because the basic unit economics are not in place, the monthly cash burn just goes through the roof.

Here's what it can look like...

The result? Crash and burn.