How Customer Data Collection For Startups Transitions From Qualitative to Quantitative

On day one of a startup there is very little customer data. The founders have an understanding of a problem that exists and they have an idea of how they might solve that problem.

Whereas, in a later stage internet business in a high growth phase there can be stacks of useful data.

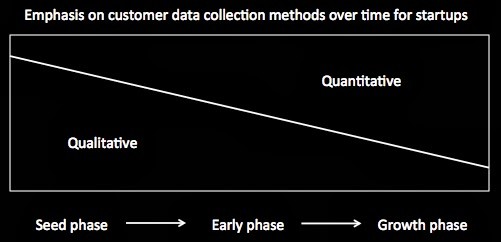

My observation is that there is a transition that happens from the early days of a company to it's later growth stages in terms of the types of customer data gathered and used.

In simple terms the transition is like this; useful customer data at the beginning is mainly qualitative. At the later stage the emphasis turns to quantitative.

This is a simplistic model and reality will be different on a case by case basis. At no point would I advise any company to rely purely on qualitative or quantitative data sources.

- Qualitative data is the useful data gathered from unstructured sources such as customer interviews. Sentiments, intentions, motives and behaviours can be understood (to a certain degree)

- Quantitative data on the other hand is the useful data gathered from structured sources such as clicks, conversion rate, basket size, repeat visit rates, net promoter score, cost per conversion etc.

At Forward Partners, we help our entrepreneurs to uncover as much useful customer data as possible at each step of the journey. In the early days our team can help conduct customer interviews. Landing page experiments can be conducted to capture customer contact details. We can then ask these customers questions and start to really understand their needs.

We'd also help make sure from the earliest days, the product is set up with analytics baked in so activity data can be gathered. This quantitative data becomes more reliable as more visits and transactions take place.

Once transactions are becoming more frequent and predictable our team can help set up optimisation tests such as split tests.

The questions that entrepreneurs ask change along the way. It starts with questions such as "how do we know our customers have a problem?" and "are our customers willing to pay for solving that problem?". Later on questions are different, such as "are we improving conversion?" and "what is the cost of customer acquisition?"

An emphasis on "who, why, what" moves towards "when, how often, how much". To answer these questions, sometimes you need conversations and sometimes you need tracking tools and numbers.

Both are important.