Understanding Your Sales Model

What makes a good company? What do investors look for?

The obvious questions are commonly known..

- what is the market size?

- is the team capable?

- does the product solve a real need?

There's another question that many companies underestimate, particularly for B2B products (although it equally applies to B2C)...

Does the sales model suit the pricing?

Quite simply, the speed at which a company can grow depends on the payback period from sales.

An example;

- Product sells for £6,000 a month

- Marketing cost was £5,000

- Sales cost was £15,000 (wages, commission)

- Support cost is is £1,000 a month

The cost of sale is £20,000 (marketing plus sales)

The margin is £5,000 (price minus support costs)

It will take 4 months before we start making a return on the cost of sale - the payback period.

That works, right? It would be amazing if the payback period was 3 months or 2 months. Still, at 4 months, the investment makes sense.

If the payback period was more than 12 months, it wouldn't make as much sense. I would have to have enough cash to fund a sales team for a year or more before I saw any revenue for their efforts.

The payback period therefore affects how many people can be employed on sales and/or how much is spent on marketing. Indeed, it may be that I can't employ anyone on sales because my price point is too low.

Low price point vs. low cost of sales

Sounds simple? It's amazing how many startups struggle with this.

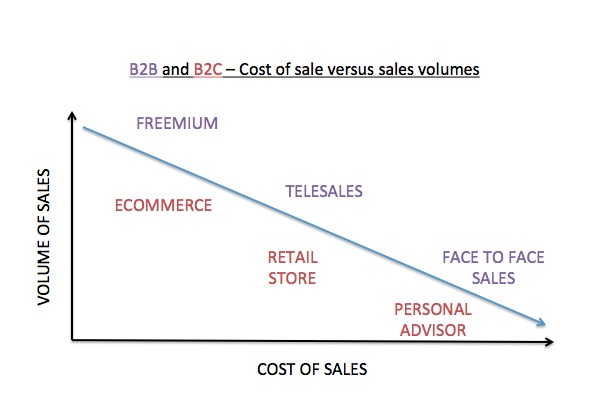

The graph below simplifies this thinking...

Subscription: if you only charge £10 a month - you can't afford a telesales team.

Consumer: If you only make £0.25 margin on a £10 transaction you're not in a position to open your own retail store for your own product.

A startup needs to understand their cost of sale and whether their pricing can support this.